OneCashPay APK is a safe and convenient lending platform for Nigerian citizens. Our goal is to provide customers with a convenient experience while applying for online loans. We take the protection of your privacy very seriously and will only do this with your express consent.

This App is a simple and secure cash loan application. This app provides the best collection of online financial assistance services. Hence, users get a quick and easy lending system on Android devices. Moreover, it is a complete application to access various services. Details of available facilities can be found here.

Overview

It is an Android financial application. Get instant loan services at low-interest rates. Additionally, this app provides proactive services with a support system. Enjoy access to all the unique features available.

Basically, credit services are offered by banks and other financial companies. However, most of these platforms have a long list of requirements. Additionally, the process of approving or rejecting an application takes time. So, the overall process is very long for everyone. So, here you get a new opportunity to take a loan.

Who is Eligible:

- Nigerian citizen;

- At least 18 years old;

- An employee or self-employed person with a stable source of income

Loan amount, tenure, interest, and contractual penalties

- Loan Amount: NGN 7,000 to NGN 200,000

- Loan Period: 91 days ~ 360 days

- Annual Percentage Rate (APR): 8% ~ 25%

Example:

If the loan amount for 91 days (3 months) is Rs. 20,000, then the APR is 20%, with interest plus the total amount payable on the due date.

Interest: ₦20,000 * 20% / 365 * 91 = ₦997

Capital payment = ₦20,000

Total Payment Amount: ₦20,000 + ₦997 = ₦20,997

Because the repayment period is 3 months:

Monthly payment is ₦20,997 / 3 = ₦6,999

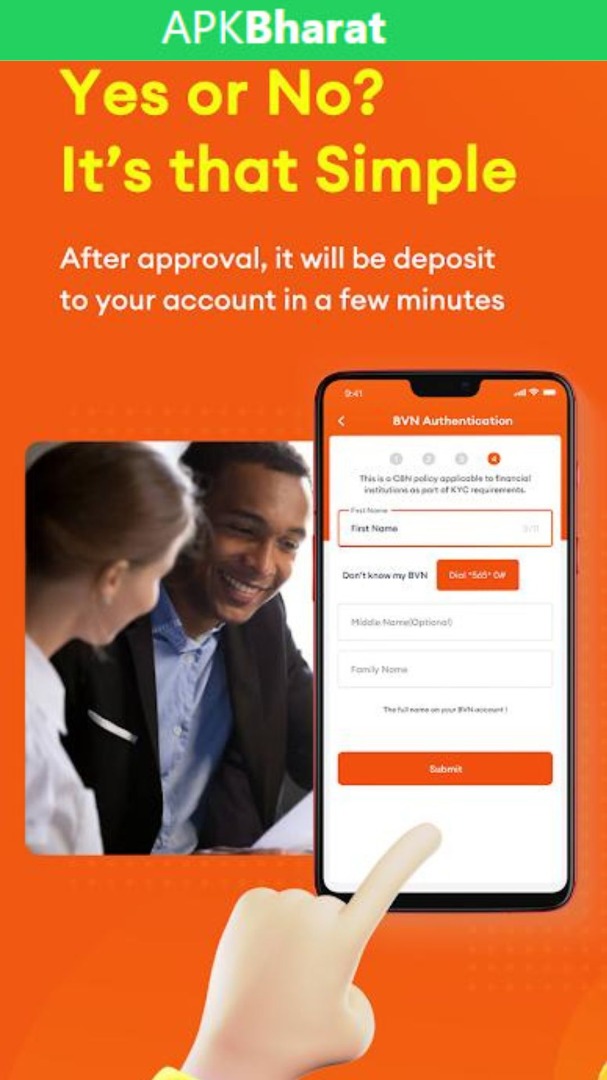

How to Apply:

- Download App

- Register an account using your phone number

- Complete the required information.

- Apply.

- Be present for approval

Conclusion:

Ultimately, a journey through OneCashPay APK's capabilities and benefits outlines a larger story of digital advancement and financial inclusion. It's a testament to how technology can close the access gap and give more people the tools to manage their money safely and easily. As we look to the future, the role of apps like OneCashPay App will undoubtedly become increasingly important in our digital lives, changing our expectations of what is possible in the realm of personal finance.

Author:

Ankit Singh is someone who writes literary, creative, or academic works, such as books, articles, essays, poetry, plays, and more. Authors use their imagination, research, and expertise to convey ideas, emotions, and stories to their readers. They play a crucial role in shaping culture, education, and the way people perceive the world. Contact Here-Linkedin